morganharman5

About morganharman5

Why You must Consider Buying Gold Now: A Strategic Funding For Unsure Instances

Lately, the world has witnessed a series of financial upheavals that have left many buyers seeking safer havens for his or her wealth. Amongst the varied funding choices out there, gold has constantly emerged as a reliable retailer of value. As we navigate by unpredictable market conditions, geopolitical tensions, and inflationary pressures, the question arises: do you have to buy gold now? This article explores the reasons why investing in gold could be a prudent choice in the present economic landscape.

Historical Context of Gold as an Funding

Gold has been revered for centuries, not just for its magnificence but additionally for its intrinsic worth. Traditionally, it has served as a type of currency, an emblem of wealth, and a hedge against inflation. Throughout durations of financial instability, gold prices are inclined to rise as investors flock to this valuable metal for safety. For instance, throughout the 2008 monetary disaster, gold prices surged as inventory markets plummeted. This historical precedent suggests that gold can act as a secure haven throughout turbulent occasions.

Present Economic Climate

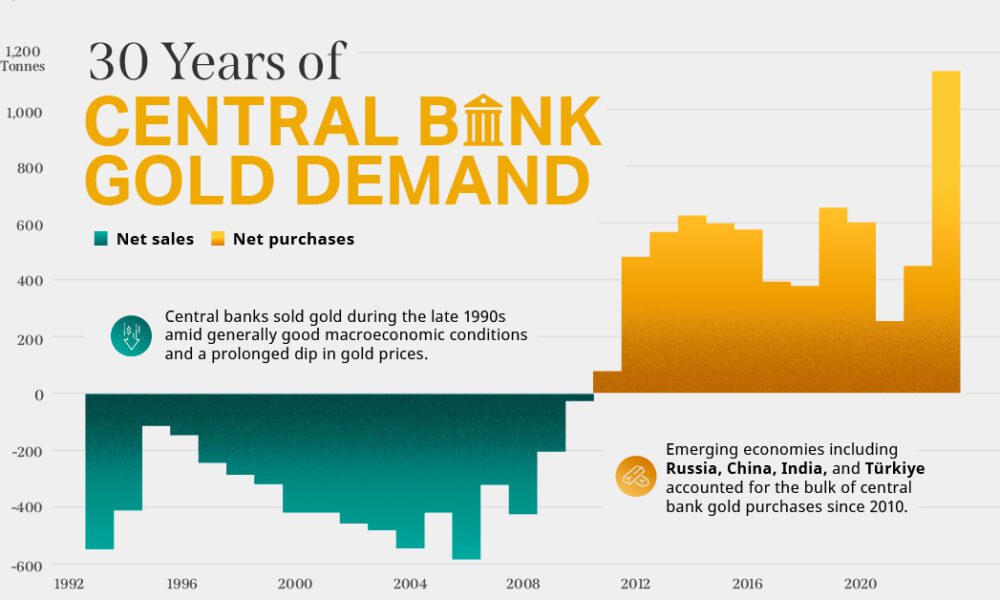

As of late 2023, we discover ourselves in a unique economic scenario characterized by rising inflation, fluctuating interest charges, and ongoing geopolitical tensions. Central banks world wide are grappling with the problem of managing inflation with out stifling economic growth. The Federal Reserve, for instance, has been adjusting interest charges in response to inflationary pressures, which might create uncertainty in the inventory market. In such an setting, gold becomes increasingly engaging as it historically retains its value when fiat currencies weaken.

Inflation Hedge

One among the primary causes to consider buying gold now is its historic function as an inflation hedge. When inflation rises, the buying power of foreign money decreases, main investors to seek property that may preserve their wealth. Gold has an extended-standing repute for maintaining its value over time, making it a great asset throughout durations of high inflation. As central banks continue to inject liquidity into the financial system, the danger of inflation remains a priority, prompting many buyers to turn to gold as a protective measure.

Geopolitical Uncertainty

Along with financial components, geopolitical tensions can significantly impression funding choices. The world is witnessing elevated instability in numerous areas, from commerce wars to navy conflicts. Such uncertainties can lead to market volatility, prompting investors to seek refuge in gold. The metallic’s status as a non-correlated asset signifies that it typically moves independently of stock markets, providing a buffer against potential losses in different investment areas. As world tensions proceed to rise, the demand for gold as a protected haven is probably going to increase.

Diversification of Investment Portfolio

Investing in gold also affords the advantage of diversification. A properly-balanced investment portfolio typically consists of a mixture of asset courses, such as stocks, bonds, and commodities. By including gold to your portfolio, you possibly can scale back overall threat and enhance potential returns. Gold’s low correlation with traditional belongings means that it will help stabilize your portfolio during market downturns. As traders seek to mitigate threat, diversifying with gold turns into an interesting technique.

Accessibility of Gold Investment

In right now’s digital age, investing in gold has by no means been simpler. Gone are the times when buying physical gold meant dealing with sellers and storage issues. Immediately, buyers can buy gold by means of varied means, including alternate-traded funds (ETFs), gold mining stocks, and digital gold platforms. These options provide flexibility and accessibility, permitting investors to decide on the strategy that most accurately fits their monetary targets and danger tolerance.

Long-Time period Worth

Whereas some may view gold as a brief-time period funding, it is vital to acknowledge its long-time period value. Over time, gold has constantly appreciated, making it a invaluable asset for wealth preservation. Not like stocks, which may be subject to market whims, gold tends to maintain its worth over many years. This high quality makes it a pretty option for these looking to secure their monetary future. By investing in gold now, you position your self to benefit from its potential appreciation within the years to come back.

Psychological Components

The psychological aspect of investing cannot be overlooked. Gold carries a sure allure and sense of safety that other property could lack. During instances of uncertainty, the mere presence of gold in an funding portfolio can present peace of mind. Traders usually feel more secure figuring out they have a tangible asset that has stood the check of time. This psychological comfort can lead to raised determination-making and a more resilient funding strategy.

Conclusion

In conclusion, the present financial panorama presents a compelling case for buying gold now. With rising inflation, geopolitical tensions, and the need for diversification, gold affords a strategic investment alternative for those searching for to protect and develop their wealth. Its historical significance as a secure haven asset, coupled with its lengthy-term value, makes it a sensible addition to any investment portfolio. As you consider your financial future, take the time to guage the potential benefits of investing in gold and how it may well enhance your total funding strategy. In the event you loved this informative article in addition to you desire to be given more information concerning buynetgold.com i implore you to go to our page. In uncertain times, gold stays a beacon of stability and safety, making it an investment worth contemplating now greater than ever.

No listing found.